Having good credit can provide buying power in emergencies or when cash is tight. It also means you can be eligible for a better rate, which can save you hundreds or thousands when financing a large purchase like furniture or a car. Credit can even be important to getting a job.

How to Check Your Credit Report

You have the right to receive one free copy of your credit report every 12 months from each of these three credit reporting agencies — Equifax, Experian, and TransUnion. To get your free annual reports you can:

- Go to: www.annualcreditreport.com

- Call: 877.322.8228

- Write to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

While there are other ways to access a free copy of your credit report, be sure to read the fine print. Other offers sometimes come with a catch like paying for expensive credit monitoring or some other service.

Disputing errors

When you review your credit report, you may find errors. Credit report errors are a common occurrence. Correcting incomplete information can provide an instant boost to your credit score. For this reason, writing a dispute letter to address any issues you find is a very important step to take as soon as possible.

Getting your credit scores

Do a quick search for credit scores on the Internet and you’ll quickly be overwhelmed. We’ve been there and done that so you don’t have to. Here’s what we figured out:

Free credit score calculators:

Myfico.com – http://www.myfico.com/fico-credit-score-range-estimator

Membership sites offering free scores:

Buying your score:

Be sure to read and understand all of the terms before signing up for any service related to credit reports or scores. Some charge ongoing monthly fees after a period of time.

How Credit Scores Work

A good credit score can save thousands of dollars on the cost of a loan and open up numerous credit opportunities. Additionally, credit scores can be used for other purposes, like hiring decisions for job opportunities. ESL gets lots of questions about credit scores, especially about how credit scores work. Here are some facts:

Likeliness to repay

Credit scores are designed to be predictors—forecasters—like telling what the weather will be. Only credit scores predict your likeliness to repay a loan. Therefore, credit scores are built to look for important behaviors and activities like paying on time...all the time.

Stacking up

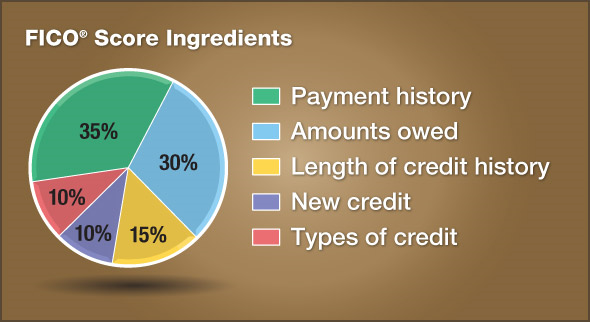

To calculate a credit score, a special formula is used to compare the information in your credit history to a statistical model. The key areas where you are stacked up against the model include payment history, balances, utilization (balances compared to limits), length, recent credit, and types of credit.

Types of scores

There are actually dozens of different scores. For example, the FICO (Fair Isaac & Company) Score, which is the most widely used model, comes with a range of 300-850. But the Vantage Score, a newer model designed for credit reports containing less information, features a range of 300-850 along with a letter grade such as A, B, C, D.

Keeping it accurate

Lastly, all credit scores are based solely on the information found in your credit report. Consequently, the accuracy of your score depends upon the accuracy of your credit report.

How to Build Your Credit Score

No matter where you are, you can do things with your credit to prove you’re trustworthy. That’s really the point. It may take time and determination, but guess what—you’re already on your way!

What’s a good credit score?

As a rule of thumb, most lenders will give loans with the best interest rates to those with a FICO score of 740 or higher. Under some other special circumstances, such as buying your first home, the credit score standards might be lower. It's always a good idea to ask your lender what the credit score requirement is before you apply.)

What makes a good credit score?

A credit score is made up of your payment history, balances, utilization (loan or credit card balances compared to limits), length of credit history, recent credit activity, and types of credit.

FICO provides the following pie chart showing the relative importance of each ingredient to your score:

Secured Cards

A tool that works great for just about anyone looking to improve their credit—a secured credit card that is backed by a security deposit made with the card issuer. Consequently, having a good credit history isn’t needed to get the card since there’s something for the issuer to fall back on.

How it might work for you

Here’s an example: You deposit $300 in a savings account. The account is frozen while you have the card. You use the card in the same manner as any other credit card—you make purchases and you pay your bill when you receive a statement. Along the way, the card issuer reports your payments to your credit history. As long as you pay on time, your credit improves. But if payments get missed, the issuer can take their losses from the security deposit.

Using a secured card the right way

To use a secured card the best way in building your credit, simply make one small purchase each month and pay the card in full and on time each month. If you buy something that you regularly buy anyway such as gas or groceries, then you won’t be spending any more than normal. And when you pay in full each month, you aren’t charged any interest.

For additional information, check out the Building or Reporting Your Credit with a Secured Credit Card booklet from Consumer Action.

Get started today with an ESL Visa Secured Credit Card.