Auto Loans Explained

A car is almost certainly a necessity for just about anyone these days. However, most of us don’t have enough cash to pay for a car. That’s why we need car loans. Here’s how they work:

- You use money you borrow from a lender to buy the car. Until the loan is paid in full they consider the car to be collateral.

- Once you pay off the loan balance, you own the car outright. The lender no longer has claim to the car.

- If you don’t make the loan payments, the lender can legally take the car and sell it to pay off the loan.

- If the lender doesn’t sell the car for enough to pay off the loan balance, you have to pay the difference.

There are three things that determine how much a car loan payment is:

- The amount of the auto loan

- The interest rate

- The length of time to repay the loan

Here are examples of three loan payments for a car purchased for $20,000:

Examples of three loan payments for a car purchased for $20,000

| Loan Amount |

Down Payment |

Interest Rate |

Length of Time to Repay the Loan |

Monthly Payment |

| $15,000 |

$5,000 |

4.50% |

48 months |

$342.05 |

| $20,000 |

$0 |

5.00% |

66 months |

$347.23 |

| $20,000 |

$0 |

5.50% |

72 months |

$326.76 |

View additional payment examples.

Preparing to Buy a Car

It can be hard to plan ahead and prepare to buy something that you need and want right now. Being prepared is your best bet to get the right car, a good loan, and pay it off successfully.

To prepare yourself, think about the following:

- You should determine the right car based on these main categories:

- What you can afford

- Reliability

- Gas mileage

- Insurance costs

- Fit with your lifestyle

- Know the value of the car you want to buy or sell ahead of time. Visit Kelley Blue Book or any of the well-respected car appraisal websites.

- Credit scores of 730 or higher get the best available deals. You may qualify with lower FICO scores, but additional costs may apply.

- The bigger the down payment you make on the car, the less you have to borrow, and the lower your monthly payment will be.

- Consider how long you plan to keep the car and carefully determine the right repayment length of time for you.

Shop for a Loan

These days there are countless options when it comes to car loans. Unfortunately, not all loans are created equal. Here are the steps that we’ve found to be most helpful when shopping for the best loan:

Step 1 – Know Your Financial Position

Take inventory of the following:

- Your credit report and score—a FICO score of 730 or higher gets the best rates.

- Make sure your income is enough for the amount of the loan you want. (The monthly payment should not exceed 10% of your monthly income.)

- Consider your other financial obligations.

- Figure out how much savings you need for the down payment.

Step 2 – Do Your Homework

Typically, financing a car loan comes from two options—either through a bank or credit union or through the dealer from whom you purchase your car.

Make sure you understand all the terms of your loan before you sign!

- Down payment

- Total amount you’ll finance

- Any fees or additional costs included in the loan amount

- Monthly payment

- Rate

Step 3 – Apply for the Loan

Did you know? Many participating Rochester area dealers provide the benefit of ESL best available rates with the convenience of shopping directly at a dealer. Here’s how it works:

- Go to one of our participating dealers.

- Negotiate the best deal and ask for ESL financing.

- Double check our ESL rates while you shop.

Becoming a Cosigner

Sometimes a lender may hesitate to make a loan to someone and requires having someone “cosign” the loan. This means that someone else will share the loan and assume some responsibility towards paying it back. Cosigning a loan can be very helpful for friends and family who may need help getting credit. It’s important to understand what it means to you.

- When you cosign a loan, you are promising to pay someone else’s debt if they don’t!

- If the borrower makes late payments or misses payments, you may not know about it until the car is repossessed.

- Being a cosigner affects your credit and may affect your ability to get other loans.

- Your credit score can be damaged if the primary borrower does not make monthly payments on time.

- If the car is repossessed, it will be on your credit report for seven years.

- Before cosigning, figure out if you can afford to pay the loan if you have to.

- If you decide to cosign a loan, make sure that you and the borrower talk about what to do if he or she can't make a payment. Maintain open communication.

Being Upside Down

Being upside down on a car loan means you owe more on the loan than what the car is worth. This is a very dangerous position to be in because you will not be able to pay off the loan if you sell the car or total the car in an accident. Then you’re left without a car and still have payments to make.

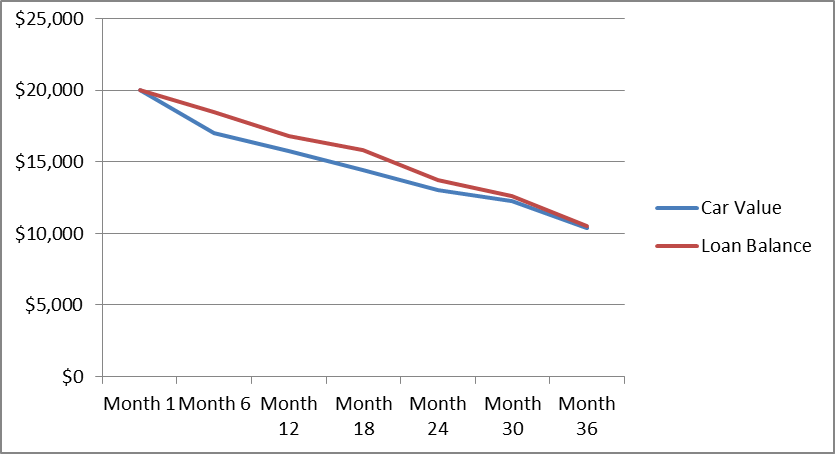

The chart below demonstrates a typical period of time where one might owe more than the value of a vehicle on a six-year loan at 5% interest with $0 down. With an accepted average rate of 15% depreciation per year, it will take roughly three years for the loan to be “right side up” again.

To minimize being upside down on a loan consider doing the following:

- Choose a vehicle that holds its value better. You can go to www.kbb.com or www.edmunds.com to learn about resale values.

- Avoid rolling the taxes and fees into your loan balance.

- Choose a loan term that is equal to or less than the amount of time you plan to keep the vehicle.

- Try to make a down payment that nears 20%.

ESL has the right car loan for you with affordable interest rates and flexible terms. Take a look at ESL Auto and Leisure Vehicle Loans or visit one of our participating dealers.